Yesterday, the International Integrated Reporting Council (IIRC) published the first revisions to the Framework since it was first published in 2013. This has been the culmination of two years work and extensive consultation with 1470 individuals, including yours truly, in 55 jurisdictions.

The most fascinating outcome has been how fit for purpose the original framework was. Given the passage of time, the light touch that resulted is remarkable. And good news because we don’t have to learn yet another change in our way of reporting.

The changes that have been made are really more about making things clearer and more actionable than anything else. All aimed to make the quality of reporting better. A couple of the tweaks really move the ‘integrated thinking’ and ‘reporting’ aspects forward a notch.

There were 22 issues that the consultation uncovered and that have been addressed. And only seven of these are ‘significant’.

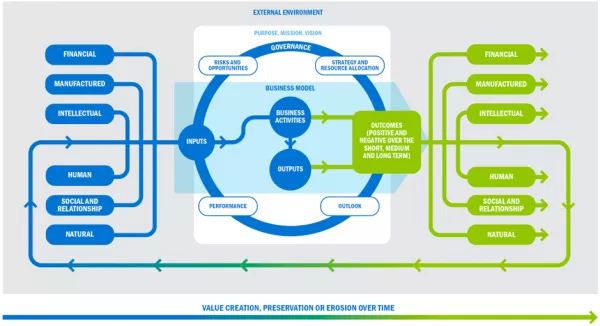

The most pertinent of these for most of us are the changes to the Value Creation Model (VCM). And this relates to distinguishing clearly between Outputs and Outcomes. Most global reports have conflated these, probably because of confusion. Have a look at the new version of the diagram:

In particular, let’s hone in on the Business Model component:

The first points that the changes make a lot clearer:

- Outputs and Outcomes are very different concepts. And both are important because it’s the Outcomes that actually impact on value

- While Outputs can directly affect Outcomes, so can your Business Activities. They revised diagram conveys this

The second point to note:

- The diagram now reminds reporters that Outcomes should be considered not just in the short term, but also in the medium and long term

The third point to note:

- It now reinforces the need for balanced disclosures. This speaks to the quality, credibility and integrity of reporting information. This means acknowledging and candidly communicating some areas in which value is eroded or simply preserved rather than just created. And declaring negative Outcomes along with the positive.

This can often be about trade-offs between the capitals, e.g. by increasing profits or providing improved customer benefits, you may perhaps create adverse Outcomes for the environment or society.

Integrated Reporting has always encouraged us to disclose the lows as well as the highs. Now the investment market globally is demanding it for their quality assessments. The revised framework now really spells that out clearly. The end-game benefit to reporters is that quality and transparency of information leads to better capital allocation and lowers the cost of capital.

Beyond the VCM, there are two more areas where the global market requested greater clarity.

- Qualitative and Quantitative information. The framework now reminds reporters that disclosures are most effective when they have a blend of narrative and metric indicators – the indicators providing the support or evidence and a basis for comparison while the narrative provides the all-important explanation and context.

- Simplifying the statement of responsibility. A bit of a technical change, but the purpose is to lower the reporting burden while not sacrificing the quality of the report. It recognises that integrated reporting is a multi-year journey and that perfection is not achieved in year one. So it lowers the responsibility on directors in particular in terms of what their sign off promises.

The future of Integrated Reporting is clear

There is no doubt that Integrated Reporting has now reached global tipping point. The principles are now visible in almost every report we see, even if they’re not purporting to be integrated reports. In particular, the notions of reporting on the things that really impact the business and its stakeholders (materiality), of value creation, of short, medium and long term planning, of the importance of non-financial information, and of connecting that non-financial information to the fortunes and health of the business – they’re obvious in every report now. And that’s a direct legacy of integrated reporting. And given the global feedback on the Framework and the very few changes resulting, it’s a way of thinking that we can say, with confidence now, has stood the test of time.

Click here to see the full new Framework.